Samples of Significant Transactions:

- Baker’s Bay Golf and Ocean Club – ultra luxury residential resort (golf & marina)

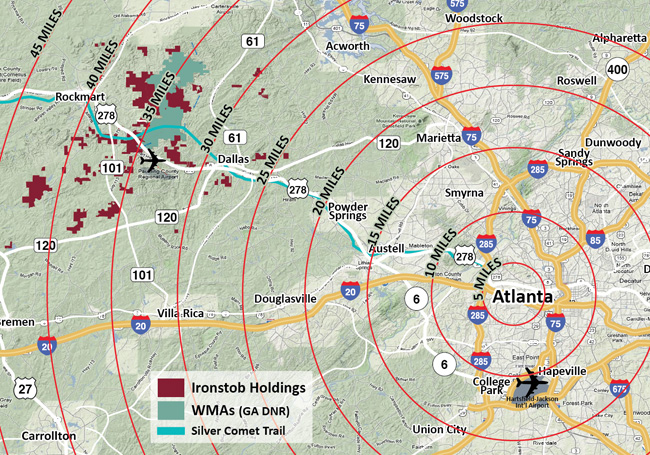

- Ironstob – 24,000 acre land assemblage

- Riverside Business Park – class A industrial development

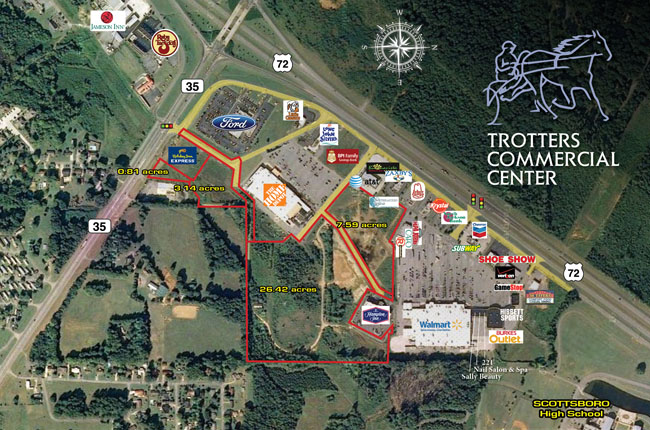

- Trotter Commercial Center – class A retail development

- North Springs Marta Station – note acquisition

Resort | Bakers Bay, Abacos, BahamasVolume: $1,000,000,000 +/- BMP formed a partnership to develop a 650+/- acre island in the Bahamas into a luxury resort at a cost of approx. $350 million, with sales of $1+ billion. Baker’s Bay remains the largest and most successful luxury residential development in the Caribbean. BMP, as principal, was responsible for the acquisition and entitlement of this 650-acre island in the Bahamas. Additionally, BMP structured the Equity Venture between one of North America’s largest Hedge Funds and Discovery Land Company, a premier developer/marketer of luxury golf resorts. The development includes approximately 384 lots, a 184-slip marina, a spa/beach/golf club, and an 18-hole golf course. |

Industrial | Riverside Industrial Park, AtlantaSquare Feet: 6,000,000 Business Park BMP developed over 6 million square feet of industrial distribution space on an 850 acre site, generating a 25+% IRR. BMP as operator, developer and financier completed all horizontal and vertical development for the park and executed 20 + transactions across 5 separate ventures until its sale in 2000. Prudential was the capital partner for the majority of the project. BMP received the Ernst & Whiney industrial award for the success of the Riverside project.  |

Retail | Trotters Commercial Center, Scottsboro, AL105 Acre Retail Center BMP acted as principal in the development, initial planning and capital raised to develop this 105 acre retail center at the intersection of US 72 and Route 35 in Scottsboro, Alabama. Phase I was completed consisting of over 210,000 square feet anchored by a Wal-Mart Supercenter. Phase II consisted of a 121,353 square foot Home Depot. BMP is currently a managing partner and is developing Phase III of the site with additional spin off site to select tenants. To date BMP has sold 14 out- parcels surrounding this strategically located development. |

Land | North Springs MARTA Station, Atlanta14 Acres in North Fulton County BMP, as principal, along with its partners, purchased a number of discounted assets from the Resolution Trust Corporation (RTC) during the late 1980s and early 1990s at extremely favorable pricing. BMP later marketed and sold all of these properties for substantial profits as the development cycle matured. One such acquisition involved 14 acres in North Fulton County. The site had been identified by transit planners for a light rail station and was acquired in auction then re-planned to meet the requirements of Metropolitan Atlanta Rapid Transit Authority (MARTA) with multi-family acreage around the station. Within two years of its acquisition, the site was successfully rezoned, with MARTA ultimately acquiring the transit station site at a price of several times the total land acquisition basis. Post Properties then acquired the remainder of the site and developed a luxury apartment complex generating an additional profit for the land venture. |